Financial perspective on modern life in America from a military spouse's perspective Disclaimer: This web site page is the opinion of the person writing it, and any financial decisions made as a result does not make the writer liable for any action taken. Please consult your personal financial advisor for more information.

Popular Posts

-

Stores offering military discounts...It's important to show them your valid military ID. From Brad's list A&W – Discount var...

-

According to Rick Maze of the Military Times, military service members and certain civilian personnel will report for duty even though there...

-

This article was published on Wives of Faith web page and was written by Stephanie Arredondo. “Honor the Lord with your wealth and with...

-

Alfa Sugar is the WWII military phonetic alphabet representing myself. My name is Stephanie Arredondo or Arredondo, Stephanie aka Alfa Sugar...

-

Final Question for the Wives of Faith Blog Carnival Why do I love being a military spouse when it is not exactly the life that I wanted t...

-

Accentuate the positiveand describe your best military wive Hoooah moment! My husband’s Guard unit was returning from Iraq. It had been a...

-

Some creative writing below where bird and military spouse parallel one another. The Wives of Faith Blog Carnival topic is to post a pic...

-

Military families as well as federal employees have a new opportunity this season to pay cash (not debt) for Christmas. eLayaway is an onl...

-

For disabled veterans and those who have served our country, there is new information relating to the Concurrent Retirement and Disability P...

-

Ever seem like there is never enough time to get it all done? If you answer no, then you need to reassess yourself and see if you can be ch...

Wednesday, June 27, 2012

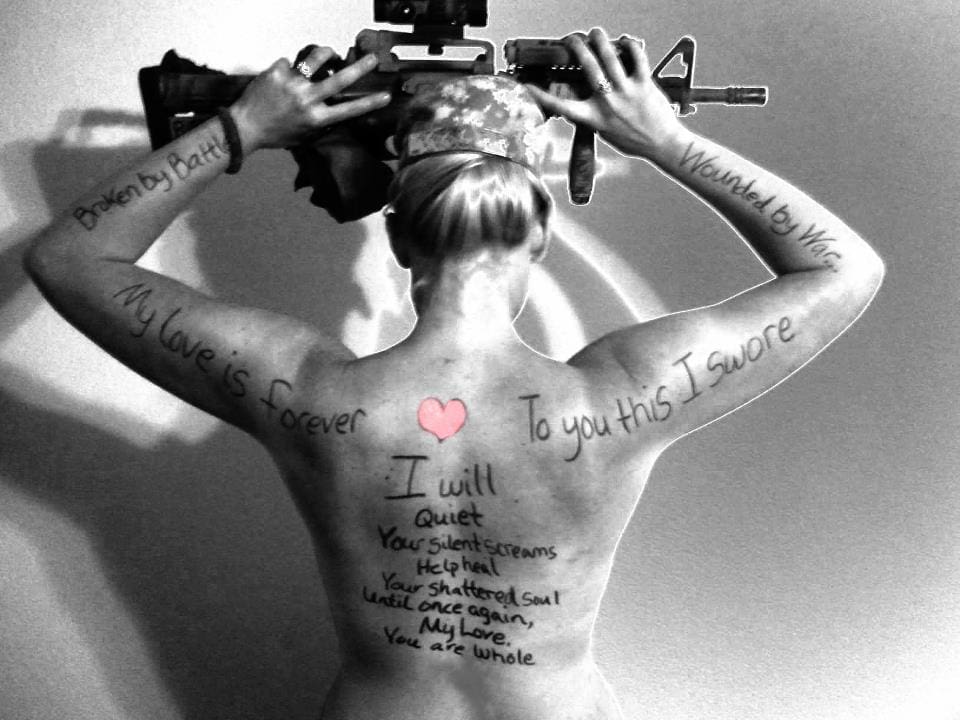

Battling Bare

In the recent article, Military Wives Strip Down to Raise Awareness about PTSD, it's a testament to what the military wives and families deal with regarding PTSD or post-traumatic stress syndrome. It is an important issue that is hindering military from getting jobs in the private sector once they discharge from the military.

At Battling Bare, a new nonprofit organization, these ladies are encouraging others to support their husbands battling PTSD. By writing the motto below on their bare back and taking a picture of it to post online, it is hoped that this attention-getting device will raise awareness to a grave situation that our military servicemembers are dealing with.

Broken by battle…

Wounded by war…

My love is FOREVER–to you this I SWORE.

I WILL:

Quiet your silent screams…

Help heal your shattered soul…

Until once again, my love…

YOU ARE WHOLE!

Battle bare.

It takes courage to reach for help only to have it thrown back in your face. Counselors and even church ministers misunderstand the issue at hand, and that leads to wrongful and hurtful diagnosis of the problem. It takes a strong military wife to weather the storm with her husband, and this Battling Bare motto is a great morale boost to those raising attention to a very delicate situation that our society and military desire to sweep under the carpet.

You DON'T throw away this marriage as many would encourage divorce and leaving the person. You DO work through the difficult situation and start another life after the military experience. It's a one day at a time challenge where you focus on the positives and forgive for those who do you wrong. (and it's okay if it takes a long time to forgive but it is key to learn to forgive and move on with your wonderful life).

Another article in the The Leaf Chronicle

Tuesday, June 26, 2012

2Q2012 Results for Alfa Sugar

We are now at 3,974 hits since Alfa Sugar went live over a year ago.

Our international audience is large and include USA, Sweden, Russia, United Kingdom, Germany, India, France, Canada, Romania, Latvia and other countries of the world.

Our top articles for this past quarter include:

160+ stores offering military discounts

Bird Picture for Wives of Faith Blog Carnival

Hurray for our Heroes

Out with the Old and In with the New

Of note, my article Bird Picture for Wives of Faith Blog Carnival won a prize in the contest. Thank you Wives of Faith and Chelesea S. of Thirty One for the pretty little organizer bag. It's used a lot at my church so I felt right in vogue using it for Vacation Bible School this summer.

This past quarter was a first for getting comments and likes.

Thank you for your support of Alfa Sugar.

Our international audience is large and include USA, Sweden, Russia, United Kingdom, Germany, India, France, Canada, Romania, Latvia and other countries of the world.

Our top articles for this past quarter include:

160+ stores offering military discounts

Bird Picture for Wives of Faith Blog Carnival

Hurray for our Heroes

Out with the Old and In with the New

Of note, my article Bird Picture for Wives of Faith Blog Carnival won a prize in the contest. Thank you Wives of Faith and Chelesea S. of Thirty One for the pretty little organizer bag. It's used a lot at my church so I felt right in vogue using it for Vacation Bible School this summer.

This past quarter was a first for getting comments and likes.

Thank you for your support of Alfa Sugar.

Retirement Considerations to achieve contentment

Per a professional financial consultant on a morning tv show, it is estimated that Americans will have to reduce their current standard of living by 60% when they retire. This is an astounding number given current financial issues.

It is estimated that Social Security will see more outflow rather than inflow occur in 2013.

Today's market is reluctant to hire people age 60 and older because of age and health matters. Even if the older worker is more reliable and knowledgeable, many employers opt to hire other candidates. The Elder Law is in place but it is difficult to prove especially in right to work states.

For those nearing retirement or in retirement, it is a mixture of concern and fear about future living conditions.

For military, it is certainly concerning. Before retirement, it is important to determine what location is best and closest to your last station. Cost of living in the local community along with any military benefits as a retiree is an added plus. Of course, it is best to review your financial statements with and without Social Security. The more you plan and research, the better you and your spouse will enjoy retirement years.

Most retirees understand that they are on fixed incomes and can't go and do like what they used to do. Scaling back from a lifestyle that was fun and fulfilling is never easy. What matters most is finding contentment with where you are in your present day living.

some considerations....

relocate to a retirement community that's more affordable for your budget

develop friendships with 55+ groups at local Ys, senior centers or other groups

take up a new hobby such as bridge, walking, or other activity that exercises your mind and body

attend church and learn more about the Bible

mentor the younger generation albeit a younger couple in their 30/40s

participate in events such as Vacation Bible Schools where there are all age groups represented

eat out at local restaurants who offer senior discounts

seek free deals

shop on senior discount days (this is not available in all states so take advantage of it if you can)

care for a pet through foster care (that way you don't pay the vet bills and can provide a loving home)

volunteer at your local library, church, school or other worthy nonprofits

manage your time wisely for retirement years

do babysit or provide childcare for grandchildren

do potlucks

learn e-mail or skype or a new technology that bridges the gap between you and the younger generation

research who offers military retirees discounts

book hotel rooms through venues that are on bases as you travel in the country

share a ride when driving across country with fellow retirees

participate in church group bus trips

smile

look at the sky

feel the rain

life is beautiful

There are many other ways to enjoy retirement years so please add more suggestions

It is estimated that Social Security will see more outflow rather than inflow occur in 2013.

Today's market is reluctant to hire people age 60 and older because of age and health matters. Even if the older worker is more reliable and knowledgeable, many employers opt to hire other candidates. The Elder Law is in place but it is difficult to prove especially in right to work states.

For those nearing retirement or in retirement, it is a mixture of concern and fear about future living conditions.

For military, it is certainly concerning. Before retirement, it is important to determine what location is best and closest to your last station. Cost of living in the local community along with any military benefits as a retiree is an added plus. Of course, it is best to review your financial statements with and without Social Security. The more you plan and research, the better you and your spouse will enjoy retirement years.

Most retirees understand that they are on fixed incomes and can't go and do like what they used to do. Scaling back from a lifestyle that was fun and fulfilling is never easy. What matters most is finding contentment with where you are in your present day living.

some considerations....

relocate to a retirement community that's more affordable for your budget

develop friendships with 55+ groups at local Ys, senior centers or other groups

take up a new hobby such as bridge, walking, or other activity that exercises your mind and body

attend church and learn more about the Bible

mentor the younger generation albeit a younger couple in their 30/40s

participate in events such as Vacation Bible Schools where there are all age groups represented

eat out at local restaurants who offer senior discounts

seek free deals

shop on senior discount days (this is not available in all states so take advantage of it if you can)

care for a pet through foster care (that way you don't pay the vet bills and can provide a loving home)

volunteer at your local library, church, school or other worthy nonprofits

manage your time wisely for retirement years

do babysit or provide childcare for grandchildren

do potlucks

learn e-mail or skype or a new technology that bridges the gap between you and the younger generation

research who offers military retirees discounts

book hotel rooms through venues that are on bases as you travel in the country

share a ride when driving across country with fellow retirees

participate in church group bus trips

smile

look at the sky

feel the rain

life is beautiful

There are many other ways to enjoy retirement years so please add more suggestions

Sunday, June 24, 2012

Money Issue

As money goes more digital, a debate is arising as to the benefits of cash or the greenback. This morning on the CBS Sunday Morning show, such a report reviewed the drawbacks of the greenback and how going digital is wonderful. Here is the link The Money Issue. Yes, handling the greenback is hazardous to your health as it is with other countries currencies.

What the report neglected to address is a couple of the following:

1) high finance charges for the card swipes...for example, Paypal charges a certain percentage. When you pay $8, then the person receiving payment has to pay taxes and employment insurance costs AND now another fee called the finance charge. It squeezes small business net profits in an economy that is struggling as it is.

2) there is less accountability for impulse spending. When you spend cold, hard cash, it's harder to release it rather than the digital component. McDonald's conducted a study whereby it was affirmed that people bought more fast food products when using a credit/debit card rather than cash.

3) there are many workers who benefit from cash payments such as babysitters, servers, valet parkers etc... There may be a drawback to criminal activity using cash transactions but when the power goes out and many people do not pay for a smartphone, why punish good hardworking people by doing away with cash? It's not a negative to pay for things in cash. It's cool.

4) Educators in schools use the greenback and coins (play money) in the classroom to teach children about money. To do away with the adult population using currency because it is likely to go digital is a challenge to teach future generations about the value of money and how to properly manage their finances. The reintroduction of personal finance in schools is necessary to train up this generation so that we as a nation don't deal with debt or overspending issues as our present generation is doing.

Not mentioned is the increase in bartering between two parties where there is an exchange of goods and services for goods and services, not cash or payment with money.

For the New York reporter who filed this news report, he should have reviewed these aspects in his report rather than allow technology to sweep him off his feet. He should go to rural America outside the NorthEastern part of this country for a true understanding of average Americans. He should also travel to various parts of the world with other military personnel see how American military families deal with international spending issues. I believe that he will revise some things in his report if he conducts further research. No offense sir but I believe that you did a decent job raising awareness and missed a few key points.

Staying with cash and the greenback will benefit this country, not the government. There are other ways for government to reduce spending and one way is to NOT adjust and do away with the greenback or coins.

This financial perspective is to elevate more understanding about the classic issue of bartering or exchange of goods and services as well as to bring light to the money issue present day.

by Stephanie Arredondo (c) 2012

(I wrote this article quickly with children playing the background, phone ringing and other household activity that can easily distract the writer because that's how important this financial perspective is)

What the report neglected to address is a couple of the following:

1) high finance charges for the card swipes...for example, Paypal charges a certain percentage. When you pay $8, then the person receiving payment has to pay taxes and employment insurance costs AND now another fee called the finance charge. It squeezes small business net profits in an economy that is struggling as it is.

2) there is less accountability for impulse spending. When you spend cold, hard cash, it's harder to release it rather than the digital component. McDonald's conducted a study whereby it was affirmed that people bought more fast food products when using a credit/debit card rather than cash.

3) there are many workers who benefit from cash payments such as babysitters, servers, valet parkers etc... There may be a drawback to criminal activity using cash transactions but when the power goes out and many people do not pay for a smartphone, why punish good hardworking people by doing away with cash? It's not a negative to pay for things in cash. It's cool.

4) Educators in schools use the greenback and coins (play money) in the classroom to teach children about money. To do away with the adult population using currency because it is likely to go digital is a challenge to teach future generations about the value of money and how to properly manage their finances. The reintroduction of personal finance in schools is necessary to train up this generation so that we as a nation don't deal with debt or overspending issues as our present generation is doing.

Not mentioned is the increase in bartering between two parties where there is an exchange of goods and services for goods and services, not cash or payment with money.

For the New York reporter who filed this news report, he should have reviewed these aspects in his report rather than allow technology to sweep him off his feet. He should go to rural America outside the NorthEastern part of this country for a true understanding of average Americans. He should also travel to various parts of the world with other military personnel see how American military families deal with international spending issues. I believe that he will revise some things in his report if he conducts further research. No offense sir but I believe that you did a decent job raising awareness and missed a few key points.

Staying with cash and the greenback will benefit this country, not the government. There are other ways for government to reduce spending and one way is to NOT adjust and do away with the greenback or coins.

This financial perspective is to elevate more understanding about the classic issue of bartering or exchange of goods and services as well as to bring light to the money issue present day.

by Stephanie Arredondo (c) 2012

(I wrote this article quickly with children playing the background, phone ringing and other household activity that can easily distract the writer because that's how important this financial perspective is)

Tuesday, June 19, 2012

Financial Struggles

Interesting news report out on gloom and doom for many folks. I believe that this is true for those who are living beyond their means. There is no question that inflationary influences are kicking in on food prices as well as basic materials as global demand is rising for these items. For military families, it is wise to learn to cook, budget and reduce spending as commissary prices though decent will take a big bite out of military household budgets.

Working Americans struggle to stay on top of things. With median hourly wages lower in 2011 than 10 years earlier, many are finding that their salaries can't keep up with expenses, especially for those whose hours have been cut as well. The NYT collects anecdotal evidence of how Americans are suffering, whether it's those that want to work longer hours, or those that can't find jobs related to their degrees.

Working Americans struggle to stay on top of things. With median hourly wages lower in 2011 than 10 years earlier, many are finding that their salaries can't keep up with expenses, especially for those whose hours have been cut as well. The NYT collects anecdotal evidence of how Americans are suffering, whether it's those that want to work longer hours, or those that can't find jobs related to their degrees.

Tuesday, June 12, 2012

Lower than anticipated family net worths

If you read the news release below from seeking alpha, it affirms the current day to day struggles that many American families are dealing with. It's also been an opportunistic time for foreign investors.

Net worth of U.S. family plummets. The net worth of the American family plunged 39% from 2007-2010 to $77,300, the lowest since 1992 as the financial crisis destroyed 18 years of gains. Leading the decline was a 42.3% dive in the average equity in Americans' homes. "What you see is an economy that’s really very, very stressed for the bottom 60%-70%,” Streettalk's Lance Roberts tells Bloomberg.

Net worth of U.S. family plummets. The net worth of the American family plunged 39% from 2007-2010 to $77,300, the lowest since 1992 as the financial crisis destroyed 18 years of gains. Leading the decline was a 42.3% dive in the average equity in Americans' homes. "What you see is an economy that’s really very, very stressed for the bottom 60%-70%,” Streettalk's Lance Roberts tells Bloomberg.

Friday, June 1, 2012

SUMMER & SAFETY REMINDERS

Pools are open. School is out. Summertime is here. Now it's time for summertime safety reminders.

Public health is an issue at pools, especially public pools. This yahoo article raises alerts about people urinating in pools and about bateria issues. Survey Public Pools like toilet bowels While everyone certanly knows to use the facilities, perhaps it's a reminder that our society needs to do better in personal hygiene.

With school out, children are playing and up to mischief with no parents around. Police are notifying neighborhood watch groups about an increase in teens and criminal activity. It is wise to have your child into healthy activities. Children look for adults to supervise and discipline even though they whine and complain.

Door to door salespeople are at it as well as traveling gypsies and other potential burglars. Awareness of who is in your neighborhood and setting your alarm system is a good way to prevent crime. Dogs barking is something to not ignore.

Preventive measures are so important for you to enjoy your summer and reduce unnecessary financial obligations.

Public health is an issue at pools, especially public pools. This yahoo article raises alerts about people urinating in pools and about bateria issues. Survey Public Pools like toilet bowels While everyone certanly knows to use the facilities, perhaps it's a reminder that our society needs to do better in personal hygiene.

With school out, children are playing and up to mischief with no parents around. Police are notifying neighborhood watch groups about an increase in teens and criminal activity. It is wise to have your child into healthy activities. Children look for adults to supervise and discipline even though they whine and complain.

Door to door salespeople are at it as well as traveling gypsies and other potential burglars. Awareness of who is in your neighborhood and setting your alarm system is a good way to prevent crime. Dogs barking is something to not ignore.

Preventive measures are so important for you to enjoy your summer and reduce unnecessary financial obligations.

Subscribe to:

Posts (Atom)